CME Group was formed in July 2007 when the Chicago Mercantile Exchange acquired the Chicago Board of Trade. CME Group is the largest futures exchange and clearing house in the world with $1,134 trillion in notional contract value from 2.25 billion contracts traded last year. Founded in 1898 as the Chicago Butter and Egg Board, the Chicago Merc demutualized and became a shareholder-owned corporation in 2000. On December 6, 2002, CME completed its initial public offering, becoming the first publicly traded financial exchange in the US. The acquisition last July of CBOT added the world’s leading marketplace for trading agricultural and U.S. Treasury futures. The CME Group has four major product areas: interest rates, stock indexes, foreign exchange and commodities. Trade execution and clearing fees constitute 81% of total company revenues. Interest rate based contracts account for 52% of transaction revenues, while contracts based upon stock indexes, principally the S&P, NASDAQ and Dow Jones, generate 29%. Foreign exchange contracts generate 8% and commodities account for the remaining 11% of transaction revenues. Each of these products enable algorithmic traders, pension funds, corporate treasurers, investment managers, hedge funds, broker/dealers and other institutions to manage their financial risks or speculate quickly and efficiently.

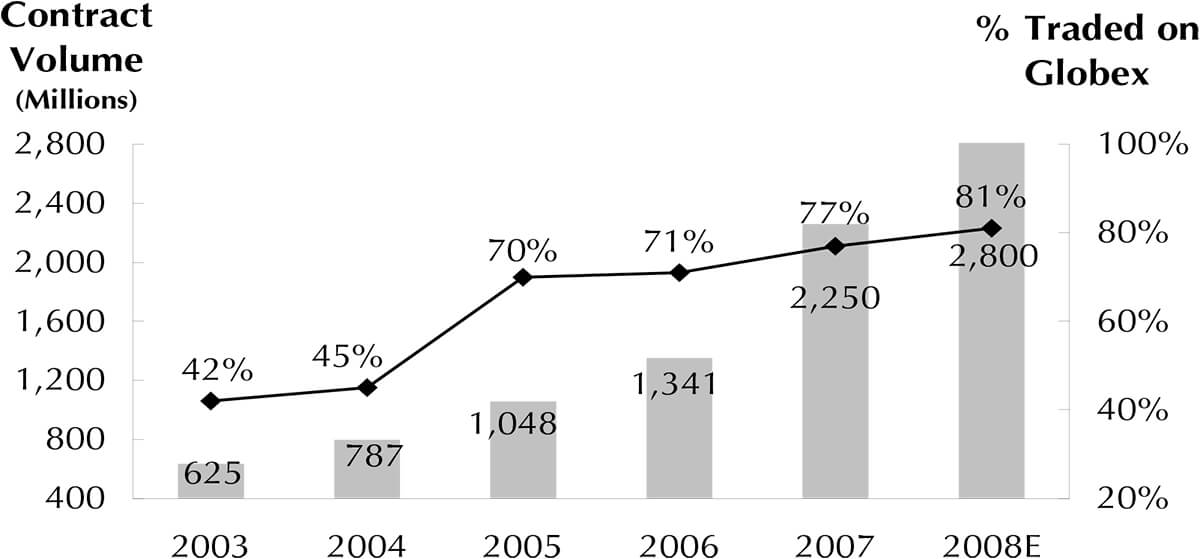

The Chicago Merc has a long history of product innovation. In 1972 it created the world’s first financial futures contracts introducing seven foreign currency futures. Prior to this, futures contracts were based exclusively upon agricultural products. Today, CME offers the largest FX marketplace in the world outside the interbank market. Eurodollar futures, the benchmark interest rate product introduced in 1981, was the first contract to be settled in cash, instead of through physical delivery of the underlying commodity. The Eurodollar, the world’s most actively traded financial contract, is a cost effective way to hedge or speculate on changes in U.S. short-term interest rates. In 1982, the CME began trading S&P 500 Index futures. Globex, the first electronic trading system for futures and options on futures was launched in 1992. Last year 77% of CME’s total volume traded electronically.

Globex operates 23.5 hours per day, five days a week and is available to customers in 80 countries via six telecommunications hubs in Europe and Asia and through nearly 1,100 direct network connections. The percentage of total volume traded outside of U.S. trading hours has reached 16%, up from 4% five years ago. New hubs are planned for Seoul, Sao Paulo and Shanghai. The open architecture of the Globex platform enables customers worldwide to access its large pools of liquidity through their own proprietary trading applications or the trading systems provided by independent software vendors and futures brokers. Globex provides customers speed of execution, transparency and anonymity. Last year 77% of the $164 million in capital expenditures were technology related. Speed and reliability upgrades reduced the processing time of the Globex match engine for options products to 5 milliseconds. In May 2008, futures response times averaged 10.7 milliseconds compared to 19.6 milliseconds during the first quarter of 2008. These speed improvements lead to greater transaction volumes and have underpinned the growth in transactions coming from computer-based algorithmic traders who now generate forty percent of total transaction volume. In April 2006, CME signed a ten year agreement with NYMEX to become the exclusive electronic trading services provider for NYMEX’s energy futures and options contracts and for metals contracts listed on its COMEX division.

CME Group operates its own clearinghouse, and thus acts as the guarantor of all transactions on the exchange. Open positions with the exchanges’ 120 clearing firm customers are marked to market twice daily to ensure adequate capital levels are maintained. The CME’s internally developed risk analysis software has become the industry standard. It has been licensed to more than 50 other exchanges and clearing organizations worldwide. In 2007, CME’s Clearing House cleared an average of 11.0 million contracts daily and 2.8 billion contracts overall. At year-end, CME held customer collateral of $59.9 billion and moved $2.2 billion a day in settlement payments. There has never been a default in its more than one hundred year history.

The market for OTC (over-the-counter) derivatives is five times larger than exchange-traded derivatives based upon the notional amount outstanding. CME has several initiatives to capture some of this vast market opportunity which today is controlled by Wall Street banks and interdealer brokers. These include FXMarketSpace, a joint venture launched in 2007 with Reuters to centrally clear OTC foreign exchange transactions, Swapstream, acquired in 2006 which provides a platform for trading and centrally clearing interest rate swaps and Credit Market Analysis, a London-based provider of pricing data to the credit derivatives market acquired in March 2008.

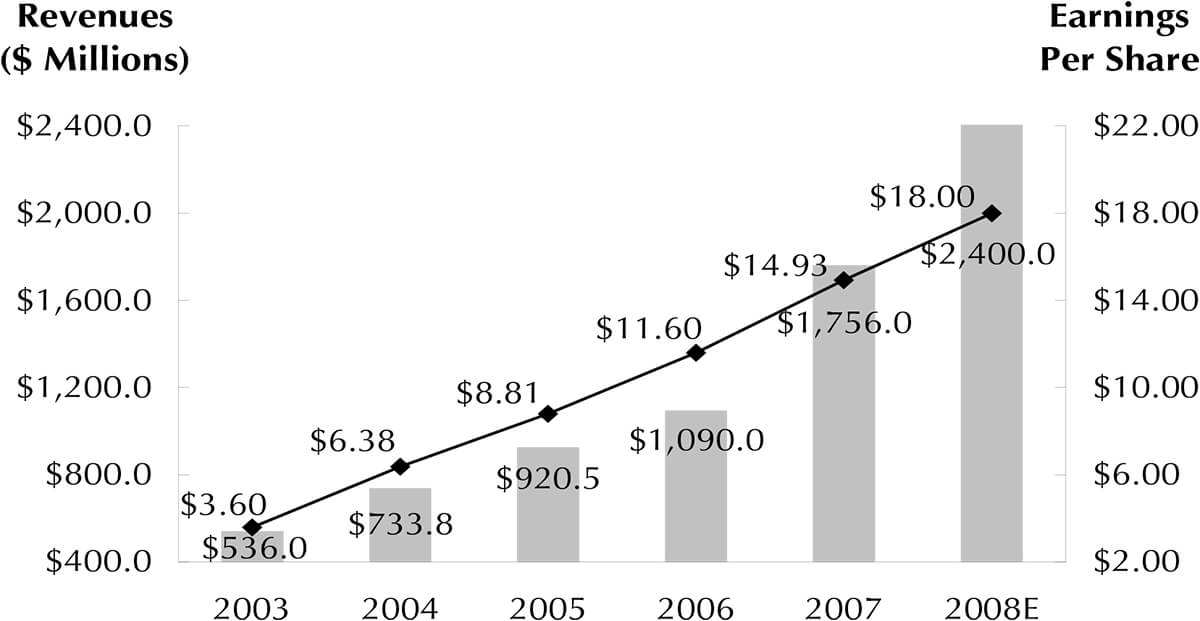

FINANCIAL PERFORMANCE

5-year compound annual EPS growth: 36%

TRADING VOLUMES