ADP is the largest third party provider of payroll, human resource outsourcing and automobile dealer network management systems in the US. On March 30, 2007, ADP completed the tax free spin-off of its Brokerage Services Division. The company is one of only six non-financial US companies to have a AAA credit rating from S&P and Moody’s.

ADP’s Employer Services business, comprising 83% of total company profits, offers a comprehensive range of human resource management solutions including payroll processing and related tax filing and reporting, direct deposit, employee benefits administration, pre-employment screening and regulatory compliance. ADP offers its clients time and labor management solutions on a hosted basis. ADP is one of the largest providers of 401k retirement plans and recordkeeping in the US. The company has 560,000 business customers worldwide with North America accounting for 88% and Europe 11%. These customers pay 54 million worldwide, one of every six non-government workers in the U.S. ADP moves more than one trillion dollars a year through U.S. and Canadian money movement systems.

Demand for global payroll and HR management services compelled ADP to invest more than $80 million to develop Global View, a complete outsourcing solution built on the SAP ERP platform enabling standardized payroll processing and human resource administration. As of July 2007, 65 clients had contracted for Global View representing 730,000 employees in 45 countries. Currently, 250,000 employees were being processed in 32 countries.

ADP has developed comprehensive multi-process solutions for mid-sized companies to provide integrated pre-employment services, workforce administration (payroll, time and labor, HR) and benefits administration which provide self service capability. This comprehensive outsourced solution now supports 61 clients with 550,000 employees and generates five times the annual revenue of the provision of payroll alone. ADP TotalSource, the company’s PEO (professional employer organization) provides US companies with comprehensive employment administration outsourcing, including payroll, HR, benefits administration, workers’ compensation insurance and healthcare insurance coverage, accounting for 5% of profit. ADP serves 4,500 small and mid-size businesses, 159,000 work-site employees in all 50 states, ranking 1st in the U.S.

An integral part of ADP’s revenues is the interest it earns on collected but not yet remitted funds as part of its payroll and tax filing service. During fiscal 2007, ADP prepared 54 million year-end tax statements (Form W-2) in the US and moved over $1 trillion in client funds to tax authorities and employees. The average daily balance of client funds of $15.6 billion is invested in short-term high-grade fixed income securities with an average maturity of 2.6 years. Declining short-term interest rates curtail profits earned on the float. The company estimates a $9 million annualized change in pre-tax profit for each 25 basis point change in interest rates. Changes in the overall level of employment, new business formations, bankruptcies and interest rates affect ADP.

Dealer Services, which comprises 12% of profits, provides 25,500 auto and truck dealers in 60 countries with network based dealer management systems. North America accounts for three-quarters of Dealer Services revenue. The dealer management system is the backbone of a dealership coordinating accounting, inventory, factory communications, scheduling, vehicle financing, sales and service, in addition to new vehicle ordering and status inquiry, warranty submission and validation, credit application decisioning, parts and repair estimates and vehicle registration.

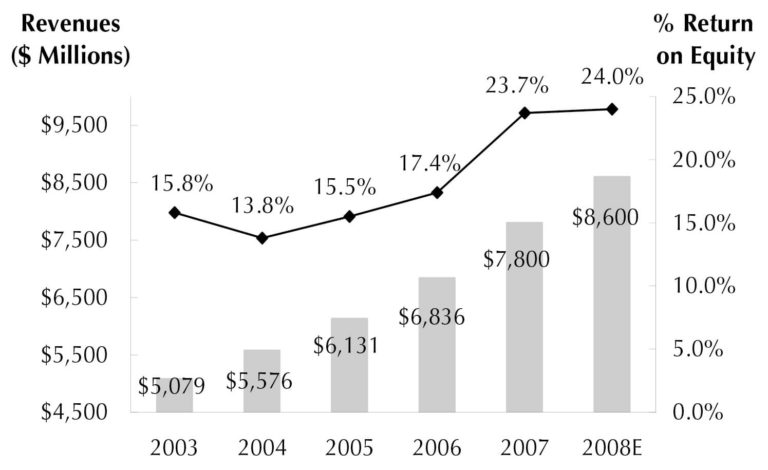

REVENUES

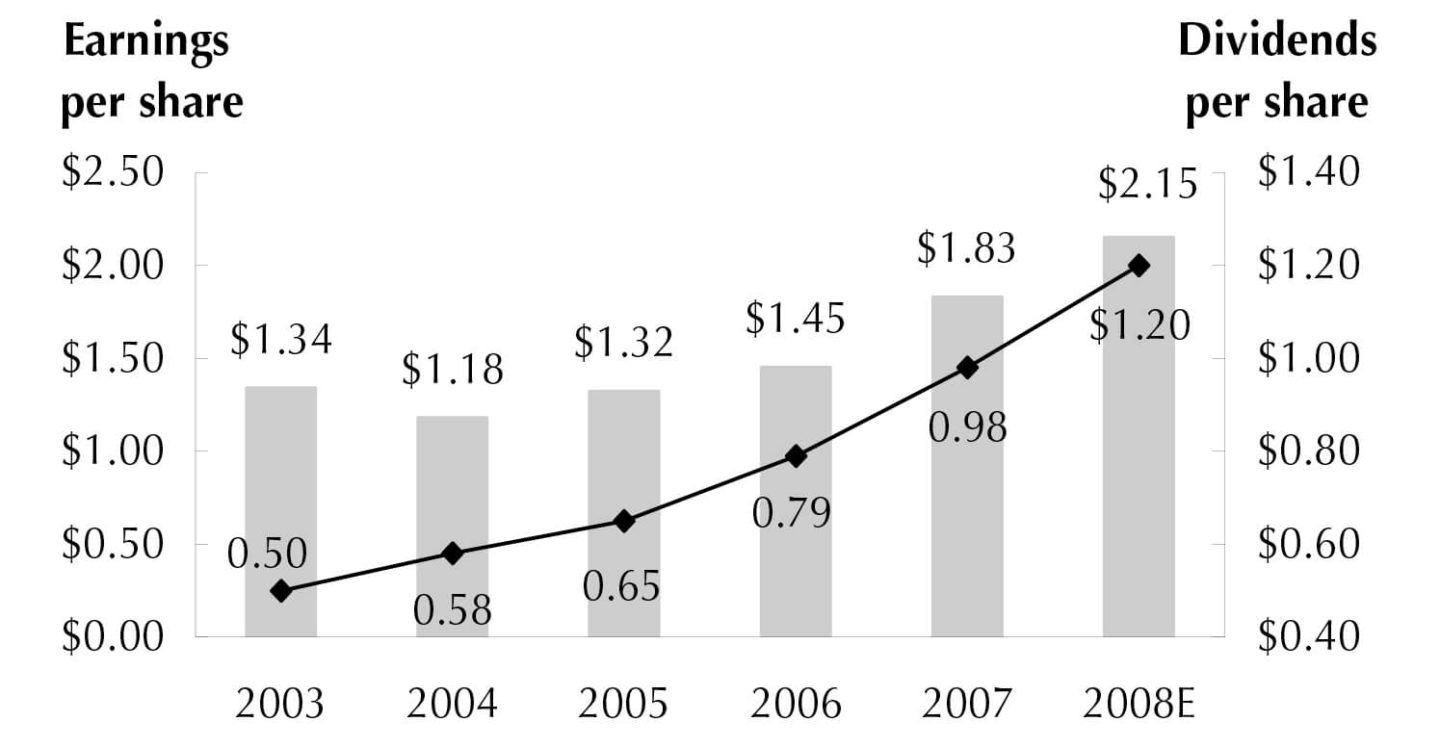

EARNINGS

5-year compound annual earnings per share growth: 8%

5-year compound annual dividend per share growth: 18%