Mettler-Toledo International is a leading supplier of precision instruments for laboratory, industrial and food retail applications. Erhard Mettler formed Mettler Instrumente AG in 1945 to manufacture single pan analytical balances. These balances are more accurate than the double pan “scales of justice.” In 1989, the company acquired The Toledo Scale Company, a market leader in industrial weighing in the U.S., and changed its name to Mettler-Toledo. Robert Spoerry, the current Chairman, was CEO of Mettler-Toledo International from 1993 to 2007. He oversaw the leveraged buy-out of the company from Ciba Geigy, a Swiss pharmaceutical and chemical manufacturer, in 1996. The company went public in November of 1997.

Mettler-Toledo is the global leader for 80% of the instruments it sells. The company has built on its strong brand leadership and reputation for innovation in weighing instruments to add to its portfolio of top-selling instruments. It has improved its profitability and the value proposition to its customers by automating weighing, analytical processes and data management through its investment in software development and robotics. With a global market share of 25% across its 22 product lines, capturing market share in existing markets offers the company the best opportunity for organic growth. The company has shifted its focus from product specifications to explanations of how to use Mettler-Toledo technology for specific applications. The company publishes semiannual newsletters that cover 34 segments in 18 languages and sends them to 800,000 customers. The significant investment in search-engine marketing and email campaigns increased “e-leads” from 3,000 to 5,000 per month since 2005. About one-third of these leads result in product sales.

The Laboratory division, which accounts for about 45% of the company’s revenues, has captured 45% of the global market for laboratory balances. Lab balances measure to a tenth of a millionth of a gram and require continuous calibration. The company has a significant R&D effort to accelerate the replacement of its installed base of these balances. QUANTOS, Mettler-Toledo’s newest balance, employs a unique dosing head to automate the manual preparation of analytical samples. Technicians currently use a spatula to place a small powder sample on a balance. The dosing head improves accuracy, avoids exposure to toxic substances and can increase throughput by 10 to 20 times. The division also sells a range of analytical instruments, including pipettes, the second most widely used instrument in life sciences labs. The pipettes have a proprietary design that reduces the force required to dispense liquids and to eject the used tips by 50% to 90% compared to its competitors. The proprietary tips contribute to the company’s consumables business which accounts for about 7% of annual revenues.

Industrial and food retailing instruments and solutions account for about 42% and 13% of revenues, respectively. Mettler-Toledo offers integrated solutions to help its industrial customers manage inventory from the receipt of bulk materials through product formulation, which usually entails weighing and mixing several ingredients, through packaging with checkweighing and contaminant detection to logistics, where equipment measures both the weight and volume of packages. Food companies install metal and x-ray detection systems in processing and packaging plants to address increased concerns about food safety. Mettler-Toledo’s Food Retail division assists large food retailers with the management of perishable foods, such as meat, cheese, fruit and vegetables. Scales used by store employees and consumers can be networked to manage inventory and control pricing from remote locations.

Mettler-Toledo’s global presence allows its multinational customers to standardize workflows and procedures. 4,000 service representatives in 40 countries provide a range of services from basic maintenance and training to calibration and validation of processes for regulatory compliance. Services are more profitable than products and account for 23% of revenues.

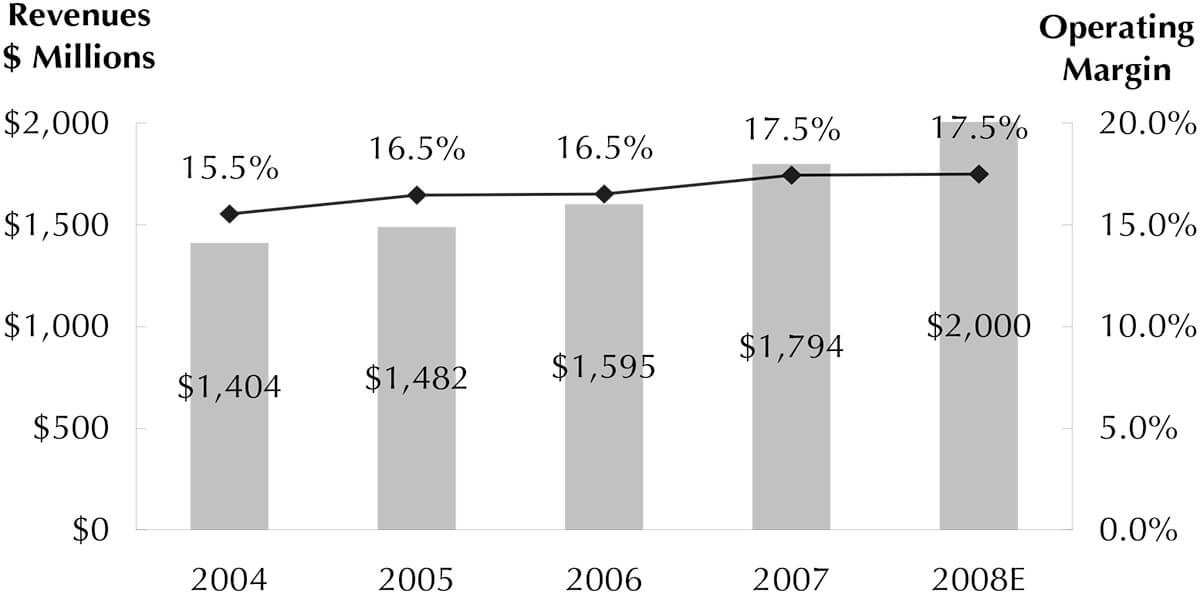

REVENUES

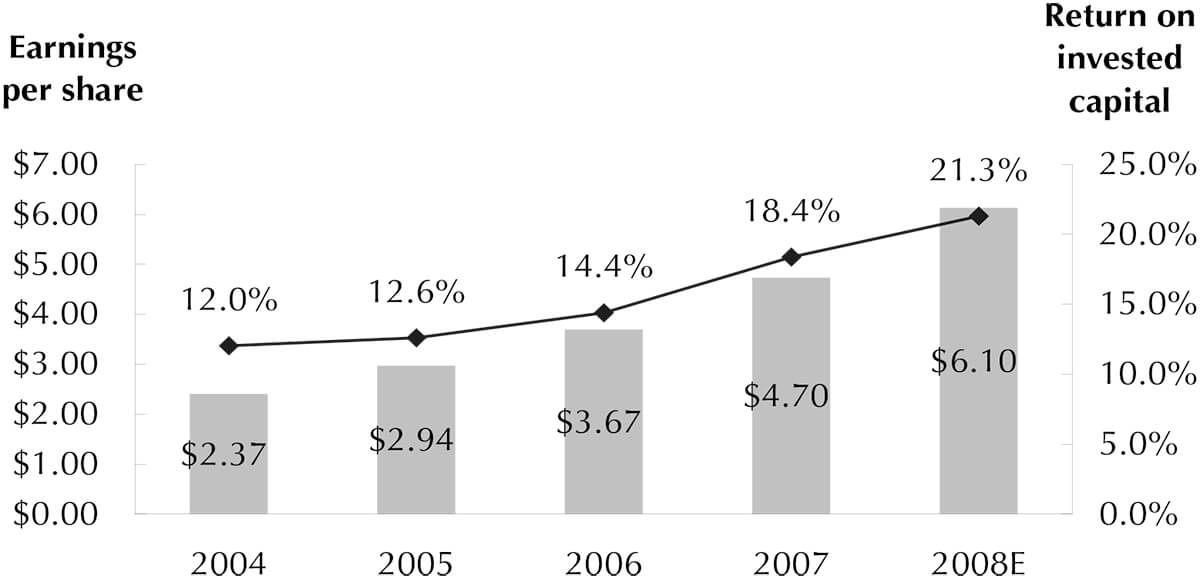

EARNINGS

5-year earnings per share compound annual growth rate: 17%