Visa, with headquarters in Foster City, CA, enables fast and secure electronic payments between consumers, businesses, banks and governments in 200 countries, but does not extend credit. The company, started by Bank America as the first consumer credit card program in 1958, evolved into a series of associations owned by regional banks operating under the global Visa brand beginning in 1976. In 2007, member banks in all regions except Western Europe reorganized into Visa, Inc., a global corporation that went public in March 2008. Member banks in Western Europe still own Visa Europe. It pays Visa an annual license fee and is legally required to make its network work flawlessly with Visa’s to maintain high service levels that protect the Visa brand. The company operates the largest global electronic payments network and is about twice the size of MasterCard, its only direct competitor.

Visa generates revenues from the banks who issue Visa-branded credit, debit and pre-paid cards. The company receives service fees which are a percentage of the payments made on its cards for supporting the issuance and use of its cards with marketing, analytics, social media and other services. Visa receives data processing revenues, a fixed fee for each transaction it processes on its network. The company also receives international revenue for processing and converting currencies for transactions where the merchant and the cardholder’s bank are in different countries. Visa always converts purchases into the cardholder’s currency at the wholesale rate, but wider spreads between the price to buy and sell a currency increase Visa’s profits. Visa offers its bank clients incentives to increase the use of its cards and marketing programs as part of long-term contracts. These volume discounts account for between 17% and 18% of Visa’s annual revenues.

Visa grows by replacing cash, which still accounts for $3.9 trillion in payments in the U.S., with safe, fast, secure and easy electronic payments. Banks and governments support this conversion because it reduces costs and leaves traceable records. Electronic payments reduce the size of cash-based informal economies which allow governments to collect more sales and income taxes. Over the past 50 years, Visa has built a network that connects 15,000 banks, 36 million merchants and over 2 billion Visa cardholders. VisaNet, the company’s centralized processing system, can process 56,000 transactions per second in 175 currencies. It examines hundreds of variables associated with each transaction in less than one second as the transaction flows from the merchant’s bank to the cardholder’s bank. During this time it assesses the risk of fraud before authorizing payment to a merchant.

Charles Scharf, Visa’s CEO since November 2012, re-engineered VisaNet to make it easier to expand and to enable safe, secure mobile commerce. The upgrade of the processing system, which took two years to complete, helped convince JP Morgan Chase, the largest and best U.S. card issuer, to sign a 10-year renewable contract with Visa to become its sole U.S. processor. Visa created a custom platform within VisaNet that enables Chase to combine its issuing and merchant services in one system. Enabling digital and mobile commerce is Visa’s largest growth opportunity. Visa helped create a standard that makes card numbers secure in the digital world and added software tools at the edge of their network to create a platform for third parties to develop applications that use Visa’s network. Apple Pay, which was launched in the U.S. in September 2014, is the first example of the use of digital card numbers and a secure chip in the phone to connect the owner of the phone with the card number. Apple’s decision to work with existing payment networks because of their size suggests that Visa will play a key role in the development of mobile commerce.

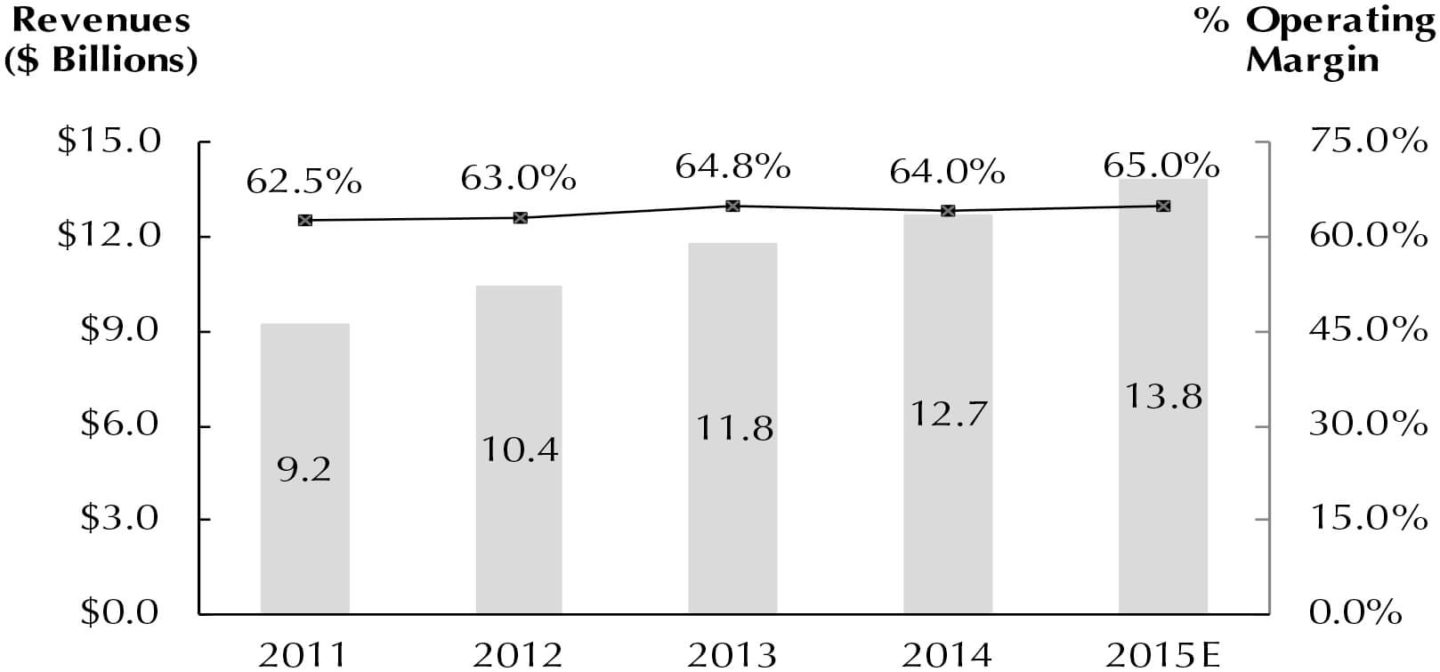

REVENUES

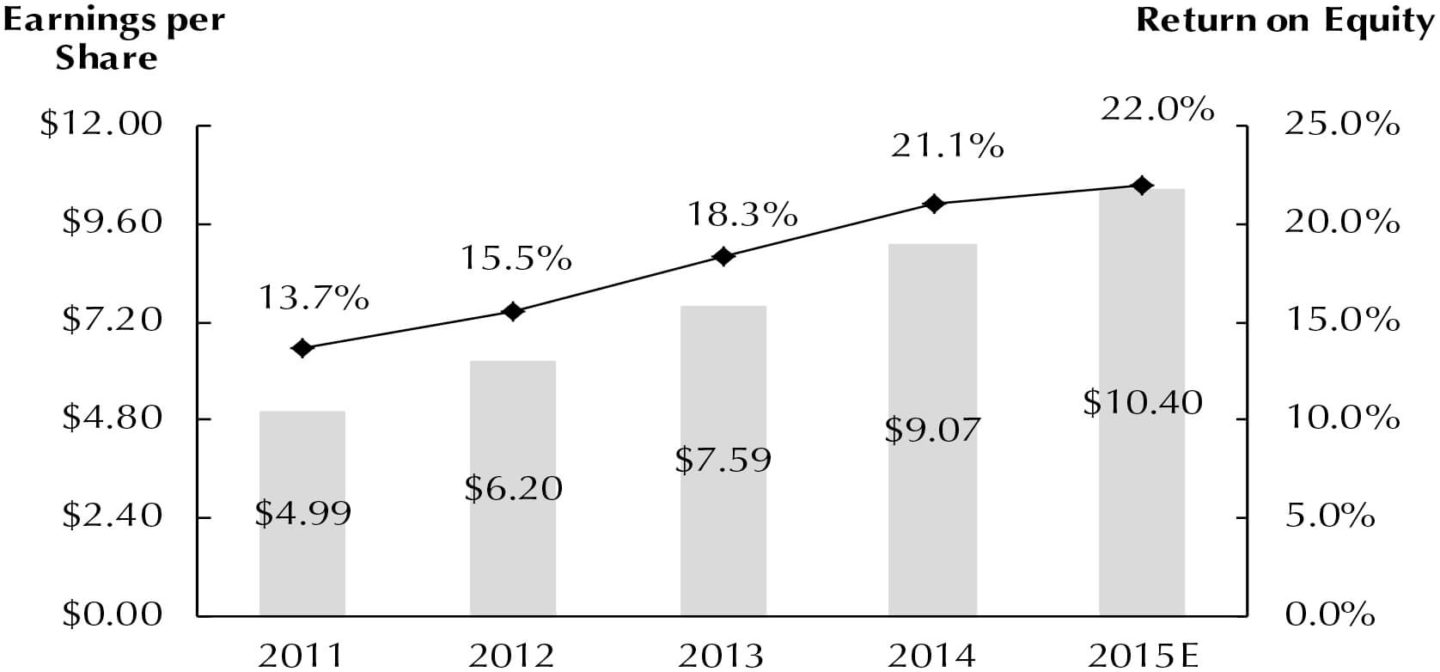

EARNINGS

Fiscal year ends September 30