PHILOSOPHY

We believe that in-depth fundamental valuation-based analysis can produce superior investment results. We invest in publicly traded companies, not sectors or macroeconomic trends. We invest in managers with experience and proven skill that is evident in strong track records. People make money, things don’t. We thoroughly evaluate how management built a business that produces persistent profitable growth, making it a possible investment candidate. We regularly meet with managers to learn how they will continue to be reliable stewards of our and our clients’ money.

STRATEGY

Capital Counsel typically invests in 15 to 25 large-cap and mid-cap companies based in the U.S. or with large U.S. operations. We choose these stocks from ideas generated through the investment team’s bottom-up research efforts. Our investment approach is guided by these principles:

- We are informed, long-term investors in companies with managements who have achieved persistent earnings growth. Their continuing ability to deliver this growth allows us to take advantage of compounding annual returns.

- We value a company as we would if we were taking the entire company private.

- We are less concerned about short-term price fluctuations than we are about finding the right investments that earn high returns and increase in value over time. Stock selection is the core of our investment approach. We learn how the companies operate and why they achieve consistently superior returns.

- We invest in companies that have sound capital structures, achieve consistently high levels of profitability, and finance their growth using free cash flow and not debt. We avoid investing in industries with regulated prices.

- We invest in our companies for an average of five years and have held many for more than a decade. This low turnover reduces taxes and trading expenses.

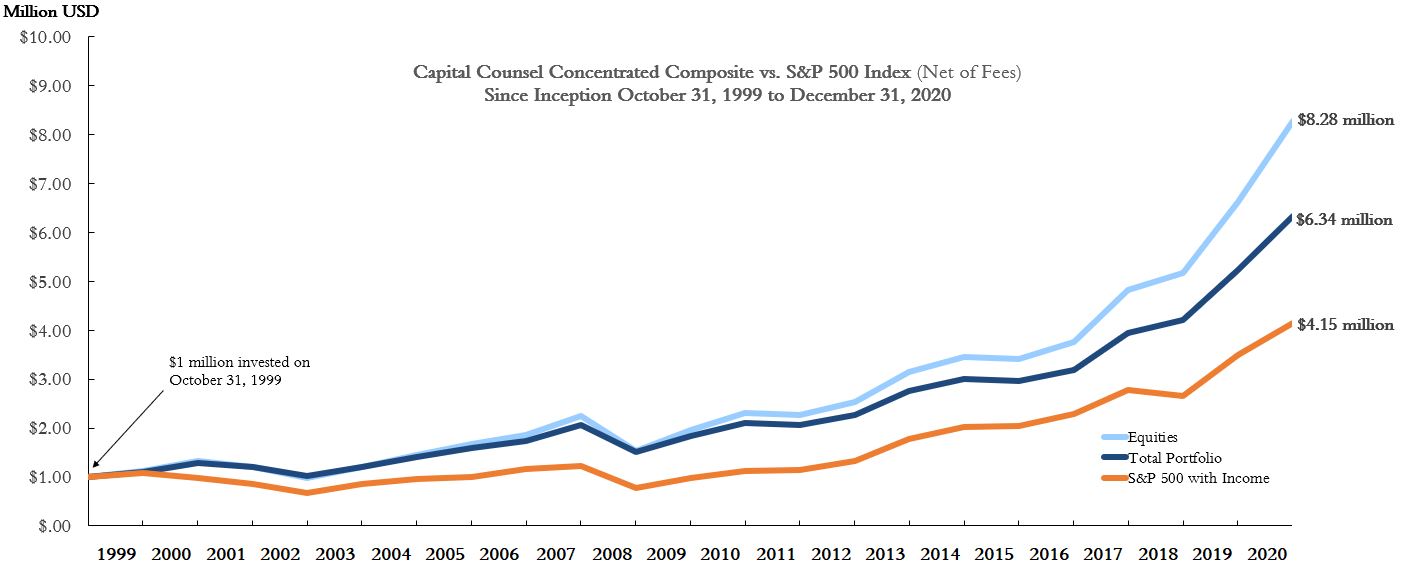

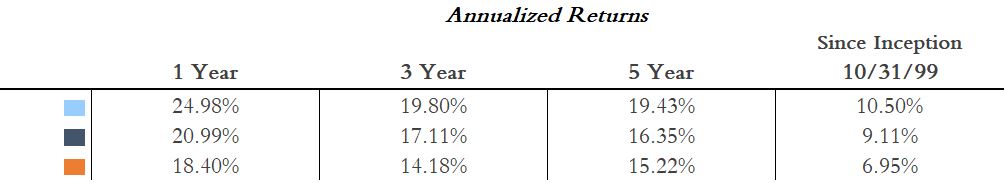

*Past performance is not indicative of future results.

*The presented information is supplemental to the GIPS Report. A full presentation is an integral part of this report and is available on request.

Disclosures

Capital Counsel Concentrated Composite contains fully discretionary taxable and non-taxable accounts. For comparison purposes, the composite is measured against the S&P 500 Index which includes the reinvestment of income. Equities must comprise at least 75% of each account for the account to enter the composite. Accounts must exit the composite if equities drop below 60% of the entire account. No one equity can hold more than 20% of each account’s combined assets. Accounts that hold fixed income securities can not enter the composite. No more than 30 equities can be held in the account. At least 80% of the equity portion of the account must be invested in the same securities as the Belle Meade Associates Combined Composite. The Belle Meade Associates Combined Composite is comprised of fully discretionary limited partnerships made up of both taxable and non-taxable accounts investing primarily in mid-cap and large-cap equity securities.

Capital Counsel LLC is an independent Registered Investment Adviser. The firm maintains compliant presentations and a complete list of composite descriptions, which are available upon request by emailing info@capcounsel.com, along with additional information regarding policies for valuing portfolios, calculating performance and preparing compliant presentations.

Capital Counsel LLC claims compliance with the Global Investment Performance Standards (GIPS®). Capital Counsel LLC has been independently verified for the periods November 1, 1999 through December 31, 2020.

The verification and performance examination reports are also available upon request. Results are based on fully discretionary accounts under management, including accounts no longer with the firm. The U.S. Dollar is the currency used to express performance. Returns are presented net of actual management fees and include all the reinvestment of income. The management fee schedule is as follows: up to $10 million – 1.0%, over $10 million – 0.9%, over $25 million – 0.8%, over $50 million – 0.7%, over $75 million – 0.6%, over $100 million – 0.5%. Actual investment advisory fees incurred by clients may vary. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.